Gross Sales vs Net Sales: Understanding Key Differences

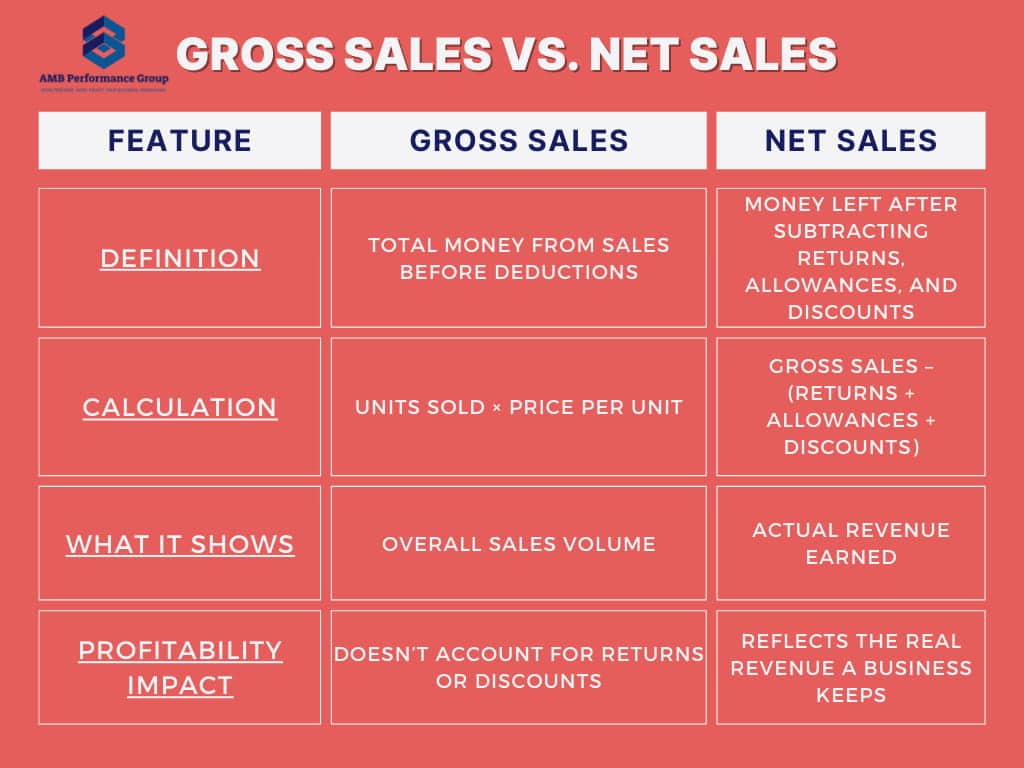

If you’re running a business, understanding your numbers is key to making smart decisions. Two terms you’ll see often in financial reports are gross sales and net sales. While they might sound similar, they tell very different stories about your revenue. Knowing the difference between gross sales vs net sales helps you track performance, plan for growth, and get a clear picture of how much money your business is actually bringing in.

In this guide, we’ll break down what each term means, how they’re calculated, and answer a common question: is net sales the same as revenue?

What Are Gross Sales?

Gross sales represent the total amount of money a business generates from selling its products or services before accounting for any deductions. It’s the raw sales number—before refunds, discounts, or allowances are taken out. Think of it as the biggest sales figure, but not necessarily the most accurate reflection of a company’s true earnings.

Gross sales are particularly useful for understanding overall sales volume and customer demand, but they don’t tell the whole financial story. That’s because they don’t consider the money that gets refunded to customers, price reductions due to promotions, or any allowances for damaged or defective products.

How to Calculate Gross Sales

The formula for gross sales is straightforward:

Gross Sales = Total Units Sold × Price Per Unit

For example, let’s say you own a clothing store and sell 1,000 T-shirts at $20 each.

1,000 × $20 = $20,000

This means your gross sales for the period are $20,000. But remember—this is before any deductions. If customers return some shirts or if you offer discounts, the actual revenue your business keeps will be lower.

Why Gross Sales Matter

While gross sales don’t reflect a company’s true earnings, they still serve an important purpose in business reporting. Here’s why they matter:

- Measure Sales Volume – Gross sales show how much product or service is being sold, which can help businesses assess overall demand.

- Identify Sales Trends – By tracking gross sales over time, companies can identify patterns, such as seasonal spikes or dips in demand.

- Set Benchmarks – Businesses often compare gross sales from one month, quarter, or year to another to measure growth or detect potential issues.

- Attract Investors or Lenders – Higher gross sales can indicate strong market demand, which may make a business more appealing to investors or financial institutions.

However, while gross sales provide a big-picture view of sales activity, they don’t show the full financial reality.

The Limitations of Gross Sales

Gross sales may look impressive on paper, but they don’t always mean a business is making money. Here’s why:

- No Profit Indicator – A business can have high gross sales but still operate at a loss if expenses (such as manufacturing, rent, and labor) are too high.

- Doesn’t Account for Discounts – Offering sales and promotions can boost gross sales, but those price cuts reduce actual earnings.

- Returns and Refunds Aren’t Included – If a business has high return rates, its net revenue will be much lower than its gross sales suggest.

Real-World Example of Gross Sales

Imagine a bakery sells 5,000 cupcakes at $3 each in a month.

5,000 × $3 = $15,000 (Gross Sales)

This number looks great, but let’s say:

- 200 cupcakes were returned because they weren’t fresh: 200 × $3 = $600

- The bakery ran a buy one, get one 50% off promo, which led to $1,200 in discounts

- A local business ordered in bulk and was given a $500 price allowance for a large purchase

Now, the bakery’s actual revenue (net sales) would be:

$15,000 – ($600 + $1,200 + $500) = $12,700

So while gross sales show total sales activity, net sales give a clearer picture of real revenue.

When Should a Business Focus on Gross Sales?

There are times when tracking gross sales is particularly useful, such as:

- Launching a New Product or Service – Helps measure demand before discounts and returns affect numbers.

- Setting Sales Goals – Useful for tracking how much product needs to be sold to hit revenue targets.

- Assessing Market Position – Comparing gross sales with competitors can help gauge industry standing.

However, when it comes to financial planning and profitability analysis, businesses should focus more on net sales, which reflect actual earnings after adjustments.

What Are Net Sales?

When looking at your business’s financial health, gross sales alone don’t tell the full story. That’s where net sales come in.

Net sales represent the actual revenue a business earns and keeps after subtracting:

- Returns – Money refunded to customers for returned products.

- Allowances – Price reductions for defective or damaged items.

- Discounts – Sales promotions, bulk discounts, or special offers that lower the final sale price.

Net sales provide a more realistic picture of a company’s financial standing because they account for the inevitable reductions that occur in the sales process.

For example, a retail store may report high gross sales, but if it has a high rate of returns or offers deep discounts, its net sales could be significantly lower. That’s why businesses focus on net sales when assessing profitability and planning for long-term success.

How to Calculate Net Sales

The formula for calculating net sales is simple:

Net Sales = Gross Sales – (Returns + Allowances + Discounts)

Let’s go through a real-world example:

Example Calculation

Imagine you run an online clothing store and your financials for the month look like this:

- $20,000 in gross sales (before any deductions)

- $1,000 in customer returns (people returning items that didn’t fit)

- $500 in allowances (discounts given for slightly defective products)

- $1,500 in promotional discounts (such as seasonal sales or coupon codes)

Now, let’s plug these numbers into the formula:

$20,000 – ($1,000 + $500 + $1,500) = $17,000

So, while your gross sales were $20,000, your net sales—the amount of money your business actually earned—was $17,000.

Why Net Sales Matter

Net sales are one of the most important numbers in a business’s financial reporting because they reflect actual revenue. While gross sales tell you how much product or service you sold, net sales reveal how much money your business actually keeps after refunds, discounts, and allowances.

Businesses Rely on Net Sales to:

- Track Real Revenue – Gives an accurate measure of how much money is truly coming into the business.

- Assess the Impact of Discounts and Returns – Helps businesses see how price cuts, refunds, or defective products affect revenue.

- Make Smarter Financial Decisions – Since net sales reflect actual earnings, businesses can use them to set budgets, plan for growth, and make investment decisions.

- Analyze Business Performance Over Time – Comparing net sales from month to month helps identify trends and make adjustments.

Net Sales vs. Gross Sales: Why the Difference Matters

Many business owners make the mistake of focusing only on gross sales because they like seeing big numbers. But here’s the reality:

- A business could have high gross sales but still lose money if discounts, returns, and allowances eat into profits.

- Investors and lenders care about net sales, not gross sales, because net sales show true earnings.

- A business with strong net sales growth over time is in a much healthier financial position than one with high gross sales but heavy returns or discounts.

Both numbers are important, but if you want a clearer idea of how much money your business actually keeps, net sales is the better metric to focus on.

What Causes a Gap Between Gross Sales and Net Sales?

Sometimes, the difference between gross sales and net sales is small, but in other cases, the gap can be significant. Here are a few reasons why net sales might be much lower than gross sales:

1. High Product Returns

- If customers frequently return items, net sales will be lower.

- Businesses can reduce returns by improving product quality, providing better descriptions, and offering strong customer support.

- Example: A shoe company with $50,000 in gross sales might see $10,000 in returns if many customers receive the wrong size.

2. Large Discounts

- Offering sales promotions can drive more sales, but cut into actual revenue.

- Finding the right balance between competitive pricing and profitability is key.

- Example: A furniture store running a 40% off holiday sale might sell a lot of couches, but its net sales will be significantly lower than its gross sales.

3. Allowances for Defective or Damaged Goods

- Some businesses give partial refunds for minor defects instead of issuing full refunds.

- These price reductions lower net sales, even if the customer keeps the product.

- Example: A smartphone company with $100,000 in gross sales might issue $5,000 in allowances for phones with minor cosmetic defects.

How to Improve Net Sales

If your business has a large gap between gross sales and net sales, you may need to adjust your strategies to keep more of your revenue. Here are a few ways to improve net sales:

1. Reduce Product Returns

- Improve product descriptions and sizing guides to avoid customer confusion.

- Use higher-quality materials to prevent defects.

- Offer better customer support to resolve issues without refunds.

2. Limit Deep Discounts

- Avoid excessive markdowns that cut too deep into profits.

- Use strategic pricing, such as bundling products instead of heavy discounts.

- Offer limited-time promotions to encourage urgency without reducing net sales too much.

3. Improve Sales Processes

- Train sales teams to focus on value-based selling instead of discount-driven sales.

- Offer upsells and cross-sells to increase overall revenue per customer.

- Streamline inventory and order fulfillment to minimize returns caused by mistakes.

4. Optimize Product Quality

- High return rates often indicate quality control issues.

- Conduct regular product testing to catch defects before items reach customers.

- Improve packaging to prevent damage during shipping.

How a Business Increased Net Sales

A small online electronics retailer struggled with high returns and deep discounts, which significantly lowered their net sales. While their gross sales were $100,000 per month, they were only keeping $75,000 after accounting for returns and discounts.

Here’s what they did to improve their net sales:

- Reduced return rates by improving product descriptions and customer reviews.

- Limited excessive discounts, switching from site-wide sales to targeted promotions.

- Improved quality control, ensuring fewer defective products were shipped.

Within six months, their net sales increased from $75,000 to $85,000 per month, even though gross sales remained about the same.

Is Net Sales the Same as Revenue?

Not always! While net sales and revenue are closely related, they are not interchangeable. Many business owners assume they mean the same thing, but there are important differences between the two.

Understanding the distinction can help businesses avoid financial miscalculations, plan for long-term growth, and make more informed decisions about their profitability.

How Are Net Sales and Revenue Different?

At first glance, net sales and revenue may seem identical, but they serve different roles in financial reporting.

- Net Sales – This is the money earned from selling products or services, but only after deducting returns, allowances, and discounts.

- Revenue – This is the total income a business earns, including net sales plus any additional income streams, such as:

- Subscription fees (e.g., a software company charging monthly for premium features)

- Licensing agreements (e.g., a business earning royalties from patents or trademarks)

- Service add-ons (e.g., a car dealership charging for extended warranties or maintenance packages)

- Interest from investments (e.g., a company earning interest from its financial reserves)

Real-World Example: Net Sales vs. Revenue

Let’s say you own a gym. Your net sales include all the money collected from monthly membership fees, minus any cancellations or discounts.

But the gym doesn’t just make money from memberships. It also earns revenue from:

- Personal training sessions

- Selling branded gym gear (T-shirts, water bottles, gym bags)

- Hosting fitness workshops or private classes

In this case:

- Net Sales = Membership fees minus any refunds or discounts.

- Total Revenue = Net sales plus income from training, merchandise, and workshops.

So, while net sales focus only on earnings from selling a core product or service, revenue includes all income sources—making it a broader measure of financial success.

Why This Matters

Knowing the difference between net sales and total revenue can help business owners:

1. Avoid Overestimating Financial Health

If a business only looks at its total revenue without breaking it down, it might think it’s more profitable than it actually is. A company could be earning revenue from one-time licensing deals or investments rather than steady product sales.

For example:

- A tech company could have high revenue one year due to a large software licensing deal.

- If they don’t separate net sales from revenue, they might assume sales are growing when, in reality, it’s a temporary boost from a licensing agreement.

By focusing on net sales, businesses can see how well their core offerings are actually performing.

2. See Where the Money Is Really Coming From

Breaking revenue into categories—net sales, investments, licensing, and services—gives a clearer picture of how a business makes money.

For example:

- If net sales are decreasing but total revenue is stable, it could mean the business is relying on other income streams instead of actual product or service sales.

- If net sales are strong and other income streams are growing, the business is likely in good financial shape.

3. Plan for Growth Based on Multiple Income Streams

A business that relies too heavily on one revenue stream may struggle if the market shifts. By understanding the breakdown between net sales and total revenue, companies can:

- Identify opportunities to diversify income sources.

- Reduce risk by not depending on one product or service.

- Focus on growing high-margin revenue streams, like premium services or licensing deals.

For example, a hotel that only focuses on room bookings (net sales) may struggle in the off-season. However, if it also earns revenue from event hosting, spa services, and restaurant sales, it can stay profitable year-round.

Which Number Should You Focus On?

Both net sales and total revenue are important, but they serve different purposes.

When to Focus on Net Sales:

- Tracking true product or service earnings – Helps businesses understand their real selling power.

- Assessing the impact of discounts and returns – Shows how price cuts or refunds affect overall earnings.

- Determining financial health for operational decisions – Useful for budgeting and setting realistic financial goals.

When to Focus on Total Revenue:

- Evaluating overall business success – Gives a broad view of all income sources.

- Attracting investors or lenders – Demonstrates total earning potential, including passive income.

- Analyzing diversification strategies – Helps businesses see which income streams are growing or declining.

Which One Matters More for Profitability?

Net sales is the better metric for understanding how much money a business is actually making from selling products or services. Since it accounts for discounts, refunds, and allowances, it provides a clearer view of real revenue.

However, businesses should also pay attention to total revenue to see where additional income is coming from. A company with multiple revenue streams is often more stable than one that relies only on sales.

Net Sales vs. Revenue

While net sales and revenue are connected, they are not the same.

- Net sales show how much money a business actually makes from selling its core products or services after deducting refunds and discounts.

- Revenue includes all income sources, such as service add-ons, licensing deals, and investments.

Key Takeaways:

- Net sales help track real earnings and profitability.

- Revenue gives a big-picture view of total business income.

- Businesses should analyze both to make smart financial decisions.

If you’re looking to improve profitability and financial clarity, start by breaking down your net sales and total revenue. This way, you can identify areas for growth, cut unnecessary losses, and build a more financially stable business.

How to Increase Net Sales

If your net sales are lower than expected, it’s a sign that too much revenue is being lost to returns, discounts, and allowances. While gross sales show the total volume of sales, net sales reveal how much money your business actually keeps after deductions.

Improving net sales isn’t just about selling more products—it’s about keeping more of the money from the sales you already make. The key is to reduce losses, improve efficiency, and increase customer retention without relying on deep discounts that cut into profits.

Here are some proven strategies to increase net sales while maintaining a healthy bottom line.

1. Reduce Returns

Why It Matters:

Returns lower net sales because businesses have to refund money, restock inventory, or even discard returned products if they can’t be resold. A high return rate is often a sign that customers are unhappy with what they receive.

How to Reduce Returns:

- Improve product quality – Customers are less likely to return items that meet or exceed their expectations.

- Offer detailed descriptions and accurate photos – Many returns happen because the product wasn’t what the customer expected. Clear images and thorough descriptions help avoid confusion.

- Provide better sizing guides – If you sell clothing or footwear, detailed size charts with measurements reduce the chance of customers ordering the wrong size.

- Use customer reviews and testimonials – Reviews give shoppers more confidence in their purchase, reducing buyer’s remorse and unnecessary returns.

- Enhance customer support – Sometimes, a return can be avoided with better service. Offering help through live chat, email, or phone support can resolve issues before they lead to a refund request.

Example: Reducing Returns in an Online Shoe Store

A company selling shoes online noticed a high return rate because customers often received the wrong size. By adding detailed foot measurement charts and allowing customers to ask sizing questions before purchasing, the business saw a 25% decrease in returns—directly increasing net sales.

2. Be Smart About Discounts

Why It Matters:

Discounting is an easy way to attract buyers, but too many discounts cut into profits and lower net sales. Offering products at a lower price may boost gross sales, but if the discounts are too deep, the business ends up making less money overall.

How to Use Discounts Strategically:

- Avoid over-discounting – Regular markdowns train customers to wait for sales instead of paying full price.

- Offer bundles instead of discounts – Selling complementary products together at a slight discount increases the total sale value while protecting margins.

- Use limited-time offers – Urgency encourages customers to buy without lowering your overall revenue.

- Target discounts to specific customers – Instead of discounting everything, offer personalized promotions to loyal or first-time customers.

Example: Bundling Instead of Discounting in a Beauty Brand

A beauty company wanted to increase sales of their skincare line without heavily discounting individual products. Instead of running a site-wide sale, they introduced a skincare bundle, where customers could get a cleanser, moisturizer, and serum together at a 10% discount. This approach increased the average order value and kept net sales high.

3. Keep Customers Coming Back

Why It Matters:

It’s more cost-effective to retain existing customers than to attract new ones. Repeat customers tend to buy more often and at higher price points, making them essential for increasing net sales.

How to Build Customer Loyalty:

- Reward loyal customers – Offer perks like exclusive discounts, early access to new products, or a points-based reward system.

- Provide excellent post-purchase support – Follow up with customers after their purchase, offer troubleshooting assistance, and encourage them to leave reviews.

- Send personalized offers and recommendations – Use customer data to send emails suggesting products they might like, based on previous purchases.

- Offer subscription-based services – If possible, introduce a monthly subscription model that guarantees recurring revenue.

Example: Subscription Model for a Coffee Company

A coffee brand introduced a monthly subscription box, where customers could receive their favorite blends automatically every month at a slight discount. This increased customer retention, ensuring steady net sales while reducing reliance on one-time purchases.

4. Improve Sales Operations

Why It Matters:

Many businesses lose sales simply because the buying process is too complicated. If customers struggle with checkout, face payment issues, or encounter poor customer service, they may abandon their purchase—or worse, never return.

How to Streamline Sales and Improve Net Sales:

- Make checkout fast and easy – A long or confusing checkout process can cause customers to leave before completing their purchase. Offer a guest checkout option and minimize required steps.

- Offer multiple payment methods – Accepting credit cards, PayPal, Apple Pay, and Buy Now, Pay Later options makes it easier for different customers to complete their purchase.

- Train sales teams to upsell and cross-sell – Encourage customers to buy related or premium products. For example, if someone buys a camera, suggest a tripod or lens.

- Use automation tools – Automating tasks like order tracking, follow-up emails, and personalized recommendations keeps customers engaged and improves sales efficiency.

Example: Streamlining Checkout for an Online Store

An e-commerce brand noticed high cart abandonment rates, meaning customers were adding items but not completing purchases. They optimized their checkout process by reducing required form fields, adding a one-click checkout option, and offering multiple payment methods. The result? A 15% increase in completed transactions, leading to higher net sales.

Focus on Profitability, Not Just Sales Volume

Many businesses focus too much on gross sales, thinking that selling more is the best way to increase revenue. However, net sales tell the real story—showing how much money actually stays in the business after deductions.

If your net sales are lower than expected, focus on:

- Reducing returns by improving product descriptions and quality.

- Using smarter pricing strategies instead of excessive discounts.

- Building customer loyalty to encourage repeat purchases.

- Streamlining sales processes to make buying easier and more efficient.

By implementing these strategies, you can increase your net sales without simply trying to sell more products at a lower price. The goal is to keep more of what you earn, reduce unnecessary losses, and create a healthier, more profitable business.

Final Thoughts on Gross Sales vs. Net Sales

Understanding gross sales vs net sales is essential for tracking financial performance. Gross sales show how much you’re selling, while net sales give a clearer picture of actual revenue.

And remember—net sales aren’t always the same as total revenue. Revenue includes all income sources, not just sales.

If you want to grow your business, improve profitability, and make smarter financial decisions, focusing on net sales will give you a more realistic view of your earnings.

Need Help Boosting Your Business Revenue?

At AMB Performance Group, we help business owners fine-tune their strategies and increase profitability. Contact us today to learn how we can help you maximize your financial success!