How to Value a Small Business: A Step-by-Step Approach for Accurate Valuation

If you’re thinking about selling your business, bringing in investors, or just want to know what your hard work is worth, understanding how to value a small business is key. Knowing your business’s value helps you make smarter financial decisions, whether you’re planning for the future or making changes now.

In this guide, we’ll break down small business valuation in a simple, step-by-step way. You’ll learn different methods to figure out what your business is worth and how to make sure you’re using the best approach.

How to Value a Small Business and Why Business Valuation Matters

Figuring out your business’s value isn’t just for selling—it can help in a lot of ways:

- Selling your business – Helps you set a fair price.

- Getting investors or loans – Banks and investors want to know your business’s worth before committing.

- Mergers and partnerships – A clear valuation makes negotiations smoother.

- Planning for growth – Knowing your value can help guide your next steps.

- Succession planning – If you’re planning to pass the business on, a valuation helps with the transition.

Now, let’s walk through the steps to value a small business accurately.

Step 1: Get Your Financials in Order

Before you can determine your business’s worth, you need a clear picture of its financial health. Think of this step as gathering all the puzzle pieces—you can’t see the full picture until everything is laid out properly.

Why do financial documents matter?

Your business’s financial records tell a story about its profitability, stability, and potential for future growth. If you plan to sell your business, attract investors, or apply for financing, these documents will be the foundation of your valuation. Even if you’re not looking to make major moves right now, keeping these records updated allows you to make informed business decisions, spot financial trends, and set realistic goals.

What financial records do you need?

To value your business accurately, start by gathering these key documents:

- Profit and loss statements (last 3-5 years) – Also called income statements, these provide a detailed view of how much money your business has earned, what it has spent, and how much profit (or loss) it has made. These statements help identify trends in revenue and expenses.

- Balance sheets – A snapshot of what your business owns (assets) and what it owes (liabilities) at a specific point in time. This is essential for understanding your overall financial position.

- Cash flow statements – These track how money moves in and out of your business, showing whether you have enough cash to cover expenses and grow. Even if your business is profitable on paper, poor cash flow can indicate financial instability.

- Tax returns (last 3-5 years) – Tax returns provide proof of your business’s earnings and financial stability. Buyers, lenders, and investors often request these to verify reported profits.

- List of assets – This includes all tangible and intangible assets your business owns, such as:

- Equipment and machinery

- Real estate or leased property

- Inventory

- Vehicles

- Intellectual property (trademarks, patents, copyrights)

- Customer lists or contracts

- List of debts and liabilities – Any outstanding loans, lines of credit, leases, or unpaid bills should be accounted for.

How do financial records impact your valuation?

The accuracy of your valuation depends on having a full, transparent financial picture. A business with well-organized, detailed financials will typically be valued higher than one with missing or inconsistent records. If your books are outdated or unclear, consider working with an accountant to ensure everything is accurate before moving forward with valuation.

Step 2: Choose the Right Valuation Method

There isn’t one single way to value a small business. The best method depends on your industry, financial situation, and the purpose of the valuation. Below are the three most common approaches:

1. Asset-Based Valuation

This method calculates your business’s worth based on the value of everything it owns. It adds up all assets and subtracts any debts or liabilities.

How to calculate asset-based valuation:

Business Value = Total Assets – Liabilities

For example, if your business has $500,000 in assets and $100,000 in debts, its estimated value would be:

500,000 – 100,000 = 400,000

When to use this method:

This approach is best for businesses with significant physical assets, such as:

- Manufacturing companies

- Retail stores with large inventories

- Construction firms with expensive equipment

However, asset-based valuation may not be ideal for service-based businesses or companies that rely on brand reputation and customer relationships rather than physical assets.

2. Market-Based Valuation

This method compares your business to similar ones that have recently sold. It works similarly to how real estate agents price homes—by looking at comparable sales in the area.

Steps to determine market value:

- Find recent sales of similar businesses – Research business marketplaces like BizBuySell or consult a business broker to see what businesses in your industry and region are selling for.

- Compare key financial metrics – Look at revenue, profit margins, and customer base.

- Adjust for unique factors – If your business has a strong brand reputation, prime location, or long-term contracts with customers, it may be worth more than the average sale price in your industry.

When to use this method:

Market-based valuation is a good fit for:

- Retail businesses

- Restaurants

- Service-based businesses

- Franchises

If there’s a lot of buying and selling activity in your industry, this approach can provide a realistic price range for your business. However, if there aren’t many comparable sales, you may need to combine this method with another approach.

3. Earnings-Based Valuation

This approach looks at how much money your business makes and its future earning potential. Buyers and investors want to know whether your business can continue generating profits.

There are two common ways to calculate earnings-based valuation:

Discounted Cash Flow (DCF) Method

This method estimates future profits and adjusts them to reflect today’s value. It’s useful for businesses with strong, predictable revenue.

Earnings Multiples Method

This approach applies a multiple (such as 2x or 5x) to your business’s net earnings or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). The multiple depends on your industry, business size, and financial stability.

How to calculate earnings-based valuation:

Business Value = Annual Earnings x Industry Multiple

For example, if your business earns $200,000 per year and the industry average multiple is 3x, your estimated valuation would be:

200,000 x 3 = 600,000

When to use this method:

- Businesses with steady profits and growth potential

- Companies with strong customer relationships and recurring revenue

- Professional services firms, such as law firms and consulting agencies

This method is ideal for businesses where earnings, rather than physical assets, are the main driver of value.

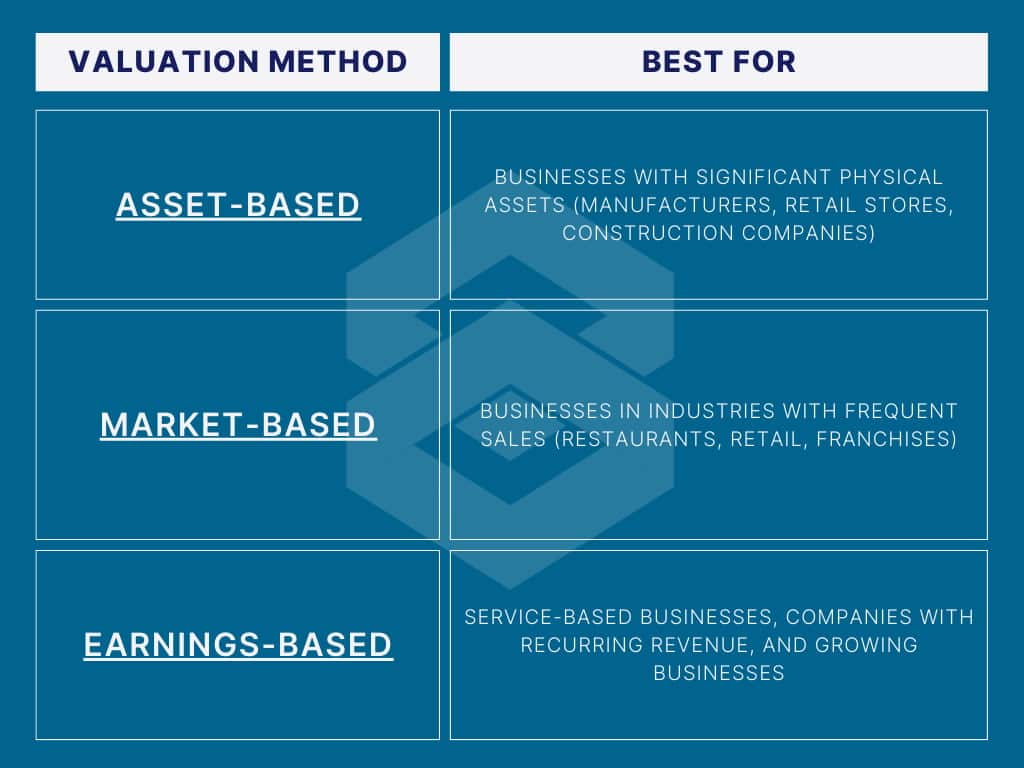

Which Valuation Method Should You Use?

The best valuation method depends on your business type and goals:

In many cases, business owners use a combination of methods to get the most accurate valuation.

If you’re unsure which approach to take, consulting a business coach or financial expert can help you get a clearer picture of your business’s worth.

Step 3: Consider Other Factors That Affect Value

When determining how much your small business is worth, the numbers only tell part of the story. While financial statements and valuation formulas provide a strong foundation, other factors can push your business’s value higher or lower. These factors may not always show up on a balance sheet, but they play a significant role in determining what buyers or investors are willing to pay.

Let’s break down some of the most important non-financial factors that influence business valuation.

1. Brand Reputation

A well-known, trusted business will always be worth more than an unknown or struggling brand. Reputation takes years to build, and buyers see it as an asset because it directly affects sales, customer loyalty, and industry influence.

Ask yourself:

- How recognizable is your brand in your industry?

- Do customers associate your business with quality, reliability, or innovation?

- Does your business have a strong online presence with positive reviews?

Businesses with a strong brand identity often sell at a premium. If your company has earned a reputation for excellence, it can justify a higher valuation.

How to improve brand value:

- Build an engaged customer base through excellent service and marketing.

- Encourage and manage positive online reviews.

- Establish partnerships or collaborations with other reputable brands.

2. Loyal Customer Base

Repeat customers are one of the strongest indicators of a business’s stability and future earning potential. If your business has a history of strong customer retention, it will be seen as more valuable. Buyers and investors want assurance that revenue will continue after they take over, and having a loyal customer base helps provide that security.

Ask yourself:

- What percentage of your customers return for repeat business?

- Do you have long-term contracts or subscriptions with customers?

- Is your customer list organized and well-documented?

How to improve customer loyalty before selling:

- Implement loyalty programs or subscription models.

- Strengthen customer relationships through engagement and personalization.

- Maintain excellent customer service and responsiveness.

3. Competitive Advantage

A business that stands out from its competitors will naturally be worth more. Competitive advantages can come in many forms, including:

- Unique products or services that no one else offers.

- Patents or proprietary technology that give you exclusive rights.

- Prime location that drives foot traffic.

- Efficient operations that lower costs and increase profitability.

If your business has an edge over competitors, that increases demand among buyers.

Ask yourself:

- What makes my business different from competitors?

- Do I have exclusive supplier relationships or unique intellectual property?

- Are there barriers that make it difficult for new competitors to enter my industry?

How to strengthen competitive advantage:

- Invest in innovation and product development.

- Protect intellectual property through patents and trademarks.

- Focus on building strong relationships with customers and suppliers.

4. Industry Trends and Growth Potential

The industry you’re in impacts your business’s value, whether you realize it or not. Buyers are more likely to pay top dollar for businesses in fast-growing industries, while businesses in declining markets may struggle to attract interest.

For example:

- A tech startup in a booming industry like AI or cybersecurity may have a high valuation, even if it’s not highly profitable yet.

- A retail store selling outdated products in a shrinking market may struggle to sell, even with strong financials.

Ask yourself:

- Is my industry growing or shrinking?

- Are there emerging trends that could impact my business’s future?

- How adaptable is my business to changes in the market?

How to increase value in a shifting industry:

- Stay ahead of industry trends and be willing to adapt.

- Invest in technology and innovation.

- Look for ways to diversify revenue streams to reduce risk.

Why These Factors Matter

While financial numbers are essential, a business’s value is also shaped by its reputation, customer base, competitive position, and industry trends. A company with strong financials but no loyal customers or competitive advantage may struggle to find buyers, while a growing business in a high-demand industry can attract a premium price.

If you’re preparing to sell or seeking investors, focusing on these intangible assets can help you position your business for a higher valuation.

Step 4: Calculate Seller’s Discretionary Earnings (SDE)

When valuing a small business, one of the most commonly used metrics is Seller’s Discretionary Earnings (SDE). This method helps determine how much money a business actually makes by adjusting for certain expenses that may not apply to a new owner.

SDE is particularly useful for small businesses with owner-operators, where personal expenses and discretionary spending can significantly impact reported profits.

What is Seller’s Discretionary Earnings (SDE)?

SDE is a measure of how much income the business actually generates for the owner, including salary, perks, and non-essential expenses. Since small business owners often run personal expenses through the business (such as a company car or travel costs), SDE helps adjust for these expenses to give a clearer picture of profitability.

How to Calculate SDE

The formula for SDE is:

SDE = Net Profit + Owner’s Salary + Discretionary Expenses

What are Discretionary Expenses?

Discretionary expenses are costs that may not be necessary for the operation of the business or would not transfer to a new owner. These can include:

- Owner’s salary and benefits – If you take a high salary, it can be adjusted in the valuation process.

- One-time costs – Legal fees, renovations, or other non-recurring expenses.

- Personal expenses – Any costs that are more personal than business-related, such as personal travel, entertainment, or meals.

By adding these expenses back to the net profit, buyers can get a better sense of the business’s true earning potential.

Using SDE Multiples to Determine Business Value

Once SDE is calculated, buyers often use an SDE multiple to estimate the business’s selling price. This multiple typically ranges from 2x to 5x, depending on industry, profitability, and risk factors.

For example, if a business has an SDE of $200,000 and a multiple of 3x:

200,000 x 3 = 600,000

This means the estimated value of the business is $600,000.

What Determines the SDE Multiple?

The multiple used to value a business depends on several factors:

- Industry norms – Some industries have higher standard multiples than others.

- Business size and stability – Larger, well-established businesses often get higher multiples.

- Growth potential – Businesses with strong future earnings potential may see higher valuations.

- Risk level – Higher risk businesses (such as startups) often get lower multiples.

Why SDE Matters in Small Business Valuation

SDE is one of the most commonly used methods for small business valuation because it provides a clearer picture of real profitability after adjusting for owner-specific expenses. It’s especially useful for buyers who want to understand how much money they can realistically expect to earn from the business.

If you’re planning to sell your business, calculating your SDE accurately and maximizing your discretionary earnings can help you justify a higher valuation.

Step 5: Compare Your Valuation to Industry Benchmarks

Once you’ve calculated your business’s value, compare it to industry benchmarks. You can look at:

- BizBuySell or similar business marketplaces – See how businesses like yours are priced.

- Industry reports – IBBA and IBISWorld offer useful valuation data.

- Financial professionals – Business brokers and valuation experts can help confirm your estimates.

Checking your valuation against these resources ensures you’re on the right track.

Step 6: Work with an Expert (If Needed)

If you want to be absolutely sure you’re getting an accurate valuation, consider working with a business coach or valuation expert. They can:

- Give you an unbiased, professional assessment

- Help you understand what increases (or decreases) your value

- Make sure your valuation holds up in negotiations with buyers or investors

Even if you do your own calculations, a second opinion can be valuable—especially if big decisions are on the line.

Final Thoughts: What’s Your Business Worth?

Knowing how to value a small business gives you a major advantage, whether you’re selling, growing, or planning for the future. By gathering your financials, choosing the right valuation method, and factoring in things like industry trends and customer loyalty, you can get a clear, realistic estimate of your business’s worth.

If you need expert guidance on small business valuation or want to take your business to the next level, AMB Performance Group is here to help. Contact us today to learn more!