What is Operating Profit? Everything You Need to Know

When running a business, one of the most important numbers to track is operating profit. It shows how much money your business makes from its everyday operations—before factoring in things like taxes and loan payments.

If you’re looking to improve your company’s financial health, understanding operating profit is a great place to start. It helps you see how efficiently your business runs and where you might be able to cut costs or boost revenue.

In this guide, we’ll break down what operating profit is, how to calculate it, why it matters, and what you can do to improve it.

What Is Operating Profit?

Think of it as a way to measure how profitable your business is based on its day-to-day activities—without getting into financial or tax-related adjustments.

You’ll find operating profit listed on an income statement, usually between gross profit and net profit.

Why Is Operating Profit Important?

It’s one of the best indicators of a company’s financial health because it focuses on business operations alone. Here’s why it matters:

- Shows how well your business is running – Since it excludes interest, taxes, and one-time expenses, it gives a clear picture of your business’s ability to generate profit from regular operations.

- Helps with decision-making – Investors and business owners use it to assess efficiency, pricing strategies, and cost management.

- Can signal financial issues early – A declining operating profit may mean rising costs, pricing issues, or inefficiencies that need to be addressed.

- Useful for comparing companies – Since it focuses only on operating income, it’s a fair way to compare businesses in the same industry.

How to Calculate Operating Profit

The formula for calculating operating profit is:

Operating Profit=Revenue−Cost of Goods Sold (COGS)−Operating Expenses

Here’s what each part of the formula means:

- Revenue – The total amount of money your business earns from sales.

- Cost of Goods Sold (COGS) – The direct costs of producing your goods or delivering your services.

- Operating Expenses – All other costs related to running your business, including:

- Rent and utilities

- Employee salaries

- Marketing and advertising

- Equipment and maintenance

What Does Operating Profit Exclude?

Operating profit does not include:

- Taxes – Income tax or other business-related taxes.

- Interest expenses – Costs from loans or borrowed money.

- One-time expenses – Unusual costs, like legal fees or restructuring costs, that don’t happen regularly.

Example Calculation

Let’s say your company earns $500,000 in revenue. Here’s how the numbers break down:

- Cost of Goods Sold (COGS): $200,000

- Operating Expenses: $150,000

Using the formula:

500,000−200,000−150,000=150,000

Your operating profit is $150,000, meaning that after covering regular business expenses, you still have this amount left before taxes and interest come into play.

Frequently Asked Questions

1. How is operating profit different from net profit?

It looks at earnings from core business activities, while net profit is what’s left after taxes, interest, and other deductions. Net profit is the final amount a company keeps as income.

2. Is a high operating profit always good?

Generally, yes, but it depends on context. A high operating profit means your business is earning well from its core activities. However, if operating expenses are cut too much—like reducing staff or marketing—it could harm long-term growth.

3. What if my operating profit is negative?

A negative operating profit means your business is spending more than it earns from its operations. This could indicate pricing issues, high production costs, or inefficiencies that need attention.

4. Can operating profit be improved?

Yes! Here are some ways to increase operating profit:

- Increase revenue – Raise prices or boost sales volume.

- Reduce COGS – Find cheaper suppliers or streamline production.

- Cut operating expenses – Optimize staff efficiency, cut unnecessary costs, or improve marketing ROI.

5. Where can I find my company’s operating profit?

You’ll find it on the income statement, listed between gross profit and net profit. Many accounting software programs, like QuickBooks, can generate this report for you.

Why Does Operating Profit Matter?

Operating profit is one of the most important financial metrics for any business. It tells you how much money your company is making from its core operations, without factoring in interest, taxes, or one-time costs. By focusing only on revenue and everyday business expenses, it gives a clear and accurate picture of your company’s financial health.

1. It Shows How Well Your Business Runs

Many business owners focus on net profit, but that number includes costs that aren’t directly related to day-to-day operations, such as taxes or loan interest. Operating profit, on the other hand, strictly measures how well your business is performing based on its normal activities.

A strong operating profit means:

- Your company is earning more than it spends on essential expenses like rent, payroll, and marketing.

- Your business model is working and generating consistent revenue.

- You’re effectively managing costs and keeping unnecessary spending under control.

A weak or declining operating profit could signal:

- Rising costs that are cutting into your earnings.

- Inefficiencies in production, staffing, or resource allocation.

- Pricing that’s too low, reducing your ability to cover expenses.

Since operating profit excludes outside financial factors, it helps you focus on improving what you can control—like adjusting pricing, cutting unnecessary costs, or optimizing operations.

2. Helps You Make Smarter Financial Decisions

Tracking your operating profit isn’t just about knowing whether your business is profitable—it’s about understanding why it is or isn’t. One way to make better financial decisions is by monitoring your operating profit margin.

What Is the Operating Profit Margin?

The operating profit margin is a percentage that shows how much of your revenue is left after covering all operating expenses. It’s calculated using this formula:

A higher margin means your business is efficiently converting revenue into profit. A lower margin might mean your costs are too high, your pricing is too low, or both.

How to use this information to make better decisions:

- If your margin is shrinking, it’s time to review costs—are expenses growing faster than revenue?

- If your profit is steady but margins are low, you may need to increase pricing or find ways to improve efficiency.

- If margins vary month to month, it could indicate seasonal trends or inconsistent spending that needs to be addressed.

Understanding your operating profit margin can help guide decisions like:

- Whether to invest in new equipment or technology.

- Whether to adjust pricing to improve profitability.

- Whether to reduce certain expenses to increase efficiency.

3. Lets You Compare Your Business to Others

Operating profit isn’t just useful for tracking your own business’s performance—it’s also a great tool for benchmarking against competitors.

When comparing businesses, looking at net profit alone can be misleading because taxes, interest, and financial strategies vary widely. Operating profit, however, reflects core business performance, making it a fairer way to evaluate how well a company is doing.

How Comparing Operating Profit Helps Your Business

- Understand your industry’s standards – If your competitors have significantly higher operating profits, you may need to investigate what they’re doing differently.

- Identify potential problems early – If your operating profit is falling while competitors’ are stable or increasing, it might indicate rising costs or inefficiencies that need attention.

- Evaluate business growth – A consistent or improving operating profit over time shows that your business is scaling effectively without unnecessary cost increases.

Many industries publish benchmark operating profit margins so businesses can compare their performance against industry averages. For example:

- Retail businesses might have an operating profit margin of 3-5%.

- Technology companies could have margins closer to 20-30%.

- Manufacturing firms may range between 10-15%.

If your business falls far below industry standards, it might be time to:

- Reevaluate pricing strategies.

- Optimize costs and cut inefficiencies.

- Improve productivity or invest in better tools.

Frequently Asked Questions

1. Can a business be profitable but have a low operating profit?

Yes. A company might still show a net profit even if operating profit is low because of factors like tax benefits, financial investments, or cost-cutting measures outside of normal operations. However, a low operating profit means the business itself isn’t generating strong earnings, which could be a red flag for long-term sustainability.

2. What is a good operating profit margin?

It depends on the industry. A good margin is typically:

- Retail & restaurants: 3-10%

- Manufacturing: 10-15%

- Software & technology: 20-30%

If your business has a margin below industry averages, it’s worth reviewing costs, pricing, and efficiency to see where improvements can be made.

3. How can I improve my operating profit?

Here are some effective ways to increase operating profit:

- Increase revenue – Raise prices, expand product lines, or improve marketing to drive more sales.

- Cut unnecessary costs – Review expenses to see if you can reduce wasteful spending.

- Improve efficiency – Streamline operations, automate processes, and reduce labor costs where possible.

- Negotiate with suppliers – Lowering your cost of goods sold (COGS) can improve margins.

4. Where can I find my operating profit?

Operating profit is listed on your income statement, between gross profit and net profit. If you use accounting software like QuickBooks or Xero, your income statement will typically calculate it for you automatically.

Operating profit is one of the most valuable financial metrics for any business. It provides a clear picture of how well your company is performing based on its core operations—without the influence of outside costs like interest and taxes.

By tracking and improving operating profit, you can:

- Make smarter financial decisions.

- Identify potential problems before they get worse.

- Benchmark your performance against competitors.

Whether you’re a small business owner or managing a large company, keeping an eye on operating profit helps ensure long-term success and financial stability.

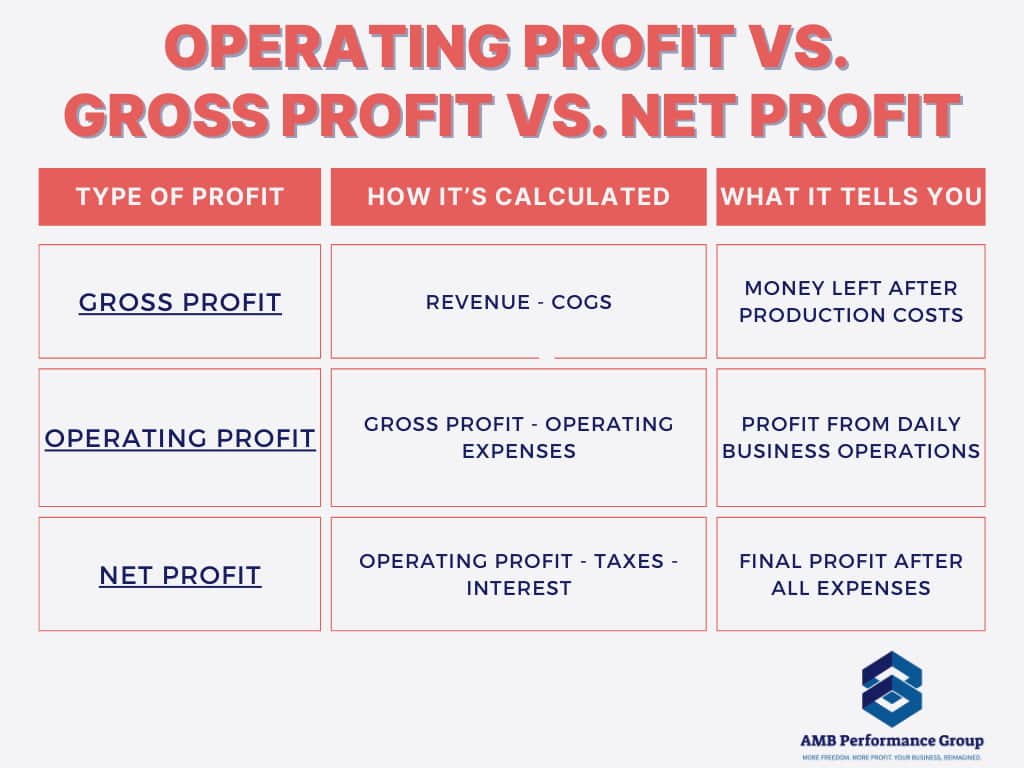

Operating Profit vs. Gross Profit vs. Net Profit

These three terms sound similar but mean different things. Here’s a quick breakdown:

Think of gross profit as what’s left after covering the cost of making your product. Operating profit shows how much you’re making from your core business. Net profit is the final number after everything else (like taxes and loan payments) is deducted.

Think of gross profit as what’s left after covering the cost of making your product. Operating profit shows how much you’re making from your core business. Net profit is the final number after everything else (like taxes and loan payments) is deducted.

What Affects Operating Profit?

It isn’t just about how much revenue your business brings in—it’s also about how well you manage expenses and make strategic decisions. Several key factors influence operating profit, and understanding them can help you improve your company’s financial performance.

1. Revenue Growth

Revenue is the total amount of money your business earns from sales before subtracting any expenses. The more revenue your business generates, the higher your potential for profit—but only if expenses stay under control.

How Does Revenue Growth Affect Operating Profit?

- More sales generally lead to higher profits, but only if you maintain healthy profit margins.

- If expenses grow faster than revenue, your operating profit may actually decrease.

- Seasonal fluctuations can impact revenue, making it important to plan for slow periods.

Example: If a company increases its sales from $500,000 to $700,000 but also sees a rise in production costs, rent, and wages, the increase in revenue may not translate into a higher operating profit.

How to Improve Revenue Growth Without Hurting Profit:

- Develop strong marketing campaigns to drive more sales.

- Offer high-margin products or services that bring in more profit per sale.

- Expand your customer base through partnerships or new markets.

2. Business Costs

Every business has operating costs—expenses needed to run daily operations. These include:

- Fixed costs (do not change with sales volume): rent, insurance, salaries.

- Variable costs (increase or decrease based on sales): raw materials, production costs, shipping fees.

How Do Business Costs Affect Operating Profit?

- Higher expenses shrink your profit margin, even if revenue stays the same.

- Unmanaged growth in costs—such as hiring too many employees or expanding too quickly—can eat into profits.

- Cost-cutting measures that don’t hurt quality can improve profit margins.

Example: A business that spends $10,000 per month on office rent may struggle to increase operating profit unless revenue increases. However, moving to a less expensive office space could help cut costs without affecting revenue.

Ways to Reduce Costs Without Hurting Quality:

- Negotiate better supplier deals to lower the cost of materials.

- Switch to energy-efficient equipment to cut utility bills.

- Improve inventory management to reduce waste and overstock.

3. Pricing Strategy

How you price your products or services has a direct impact on operating profit.

How Does Pricing Affect Operating Profit?

- Setting prices too low can attract customers but may leave little room for profit.

- Overpricing may hurt sales if customers turn to competitors.

- The right balance ensures competitive pricing while maintaining strong profit margins.

Example: If a business sells a product for $20 but its total cost (materials, labor, marketing) is $18, the profit is only $2 per unit. Raising the price to $25 while keeping costs the same would increase profit per unit without needing to sell more.

How to Improve Pricing Strategy:

- Analyze competitor pricing to stay competitive.

- Offer premium options at a higher price for customers willing to pay more.

- Use bundling strategies (e.g., selling multiple products together) to increase overall sales.

4. Productivity & Efficiency

The more efficiently a business operates, the less money it wastes, leading to higher operating profit. Productivity improvements mean getting more output from the same amount of resources.

How Does Productivity Impact Operating Profit?

- A more productive workforce leads to lower labor costs per unit of production.

- Automation and technology can reduce reliance on manual labor and minimize errors.

- Efficient processes cut down on wasted time and materials, improving profit margins.

Example: A manufacturing company investing in an automated system might reduce production time and labor costs, leading to a higher operating profit despite the initial investment.

How to Improve Productivity & Efficiency:

- Train employees to work smarter and improve job performance.

- Invest in automation to handle repetitive tasks.

- Improve workflow processes to eliminate inefficiencies.

5. Economic Conditions

Not all factors affecting operating profit are within a company’s control. Economic conditions, industry trends, and global events can all impact profitability.

What External Factors Affect Operating Profit?

- Inflation – Rising costs for materials and wages can reduce profit margins.

- Supply chain disruptions – Delays in getting materials can increase costs and slow production.

- Changes in consumer demand – Economic downturns can lead to lower spending.

- Increased competition – More competitors may force businesses to lower prices, reducing profit margins.

Example: A restaurant may see lower profits during a recession as fewer people dine out. However, a grocery delivery business might see higher profits due to increased demand.

How to Adapt to Economic Conditions:

- Stay flexible with pricing and cost strategies to adjust for inflation.

- Diversify suppliers to avoid supply chain issues.

- Offer different pricing tiers to appeal to various customer budgets.

Frequently Asked Questions

1. Can a business increase revenue but still have a lower operating profit?

Yes. If revenue increases but expenses grow even faster, operating profit can decrease. That’s why it’s important to balance sales growth with cost control.

2. What happens if operating profit is too low?

A low operating profit means the business isn’t generating enough income from its core operations. Over time, this can lead to:

- Difficulty covering fixed costs like rent and salaries.

- Less cash available for growth, investments, or emergencies.

- A need to take on loans or outside funding, which adds interest expenses.

3. How can small businesses improve their operating profit?

Small businesses can boost operating profit by:

- Raising prices slightly without losing customers.

- Cutting unnecessary expenses, like office space that’s too large.

- Improving efficiency with better technology or streamlined operations.

4. Does a high operating profit always mean a business is doing well?

Not necessarily. While a high operating profit is a good sign, businesses also need to consider:

- Long-term sustainability – Are cost reductions harming quality or employee morale?

- Industry benchmarks – Some businesses naturally have lower margins than others.

- Future investments – A company reinvesting profits into growth might have a lower short-term operating profit but better long-term potential.

How to Improve Operating Profit

If your operating profit margin isn’t where you’d like it to be, don’t worry—there are plenty of ways to improve it. Operating profit is influenced by both revenue and expenses, so boosting profitability often comes down to a combination of cutting unnecessary costs, increasing revenue, improving efficiency, and refining pricing strategies.

Below are practical steps you can take to improve your operating profit.

1. Cut Unnecessary Costs

Reducing expenses without hurting the quality of your product or service is one of the fastest ways to improve operating profit. Small cost reductions across multiple areas can add up significantly over time.

How to Cut Costs Effectively:

- Review overhead expenses – Look at fixed costs like rent, utilities, and subscriptions. Can you negotiate a better deal or switch to a lower-cost option?

- Negotiate with suppliers – If you’ve been working with the same vendors for a while, ask for a bulk discount or shop around for better pricing.

- Reduce material waste – If your business involves manufacturing or production, analyze processes to minimize waste and optimize efficiency.

- Cut unnecessary expenses – Look for recurring costs that may not be necessary anymore, such as outdated software subscriptions or underutilized office space.

Example: A retail store might save thousands of dollars per year by renegotiating lease terms or switching to energy-efficient lighting.

2. Increase Revenue

While cutting costs helps, increasing revenue is often the best long-term strategy for improving operating profit. The key is to increase sales without letting expenses rise too quickly.

Ways to Increase Revenue Without Overspending:

- Offer new products or services – Look for opportunities to expand your offerings while staying within your business’s core strengths.

- Expand into new markets – If your local market is saturated, consider selling online or reaching new demographics.

- Improve marketing efforts – Invest in targeted advertising and enhance customer experience to encourage repeat business.

- Upsell and cross-sell – Offer premium versions of your products or bundle related items to increase the average transaction value.

Example: A coffee shop could introduce a loyalty program to encourage repeat customers while also offering premium drinks at a higher price point.

3. Improve Efficiency

A more efficient business is a more profitable one. Wasted time and resources can quietly eat away at operating profit, so streamlining operations can make a big difference.

How to Improve Efficiency:

- Automate repetitive tasks – Use technology to handle tasks like inventory management, scheduling, or invoicing.

- Train employees to work more efficiently – Investing in skills development can improve productivity and reduce costly mistakes.

- Use data to track performance – Analyze key business metrics to spot inefficiencies and make data-driven decisions.

Example: A manufacturing company that invests in automated equipment may reduce production time, lower labor costs, and ultimately increase profit margins.

4. Adjust Your Pricing Strategy

Pricing plays a huge role in operating profit. Setting prices too low can make it hard to turn a profit, while pricing too high might drive away customers. Finding the right balance is crucial.

How to Optimize Your Pricing Strategy:

- Raise prices carefully – If your costs have gone up, consider small price increases to maintain margins without scaring away customers.

- Bundle products or services – Packaging complementary items together can increase sales volume and improve profitability.

- Run strategic promotions – Instead of deep discounts, offer value-added deals that encourage customers to buy more without sacrificing profit.

Example: A fitness trainer might bundle personal training sessions with meal plans to increase sales while keeping profit margins strong.

Common Mistakes to Avoid

When trying to improve operating profit, businesses sometimes overlook key factors or make mistakes that hurt their bottom line.

Here are three common pitfalls to watch out for:

1. Confusing Operating Profit with Net Profit

Operating profit is not the final profit your business makes. It excludes interest payments and taxes, so while it’s a strong indicator of business health, it’s not the full picture.

What’s the Difference?

- Operating profit shows how much money your business earns from its core activities before interest and taxes.

- Net profit is what’s left after deducting all expenses, including taxes and debt payments.

Solution: When evaluating business performance, focus on both operating profit and net profit to get a complete understanding of financial health.

2. Ignoring Industry Benchmarks

Every industry has different expected profit margins, so comparing your business to the wrong benchmark can lead to unrealistic expectations.

Why This Matters:

- A retail store might have an operating profit margin of 5-10%, while a software company could have 20-30% margins.

- If you’re in a low-margin industry, your goal should be improving efficiency rather than expecting unrealistic profit percentages.

Solution: Research industry benchmarks and compare your performance to similar businesses, not just general profit margin numbers.

3. Overlooking Hidden Costs

Some expenses don’t seem significant on their own but can quietly reduce operating profit over time.

Common Hidden Costs That Hurt Operating Profit:

- High employee turnover – Hiring and training new employees frequently can be costly.

- Maintenance and repairs – Failing to maintain equipment can lead to unexpected expenses.

- Outdated technology – Using old or inefficient systems can slow down operations and increase costs.

Solution: Conduct regular cost audits to find and eliminate unnecessary spending before it affects your profit margins.

Final Thoughts

Understanding operating profit helps you see how well your business is doing and where you can make improvements. Whether it’s cutting unnecessary costs, increasing revenue, or improving efficiency, focusing on this number can lead to long-term financial success.

At AMB Performance Group, we help business owners maximize their profitability through expert coaching and strategic planning. If you want to take your business to the next level, contact us today to learn more!